People often rely on a spreadsheet to track finance and expenses. Now we have modern solutions to add and manage expenses as well as investment and income with various categories and export options.If you plan to use such an app on Mac, then read along to learn about the top five finance apps for macOS.

The Mac users in the GT team use a dedicated budget app on the Mac to track their monthly expenses. So let’s discuss our picks in detail.

1. MoneyWiz Finance Tracker

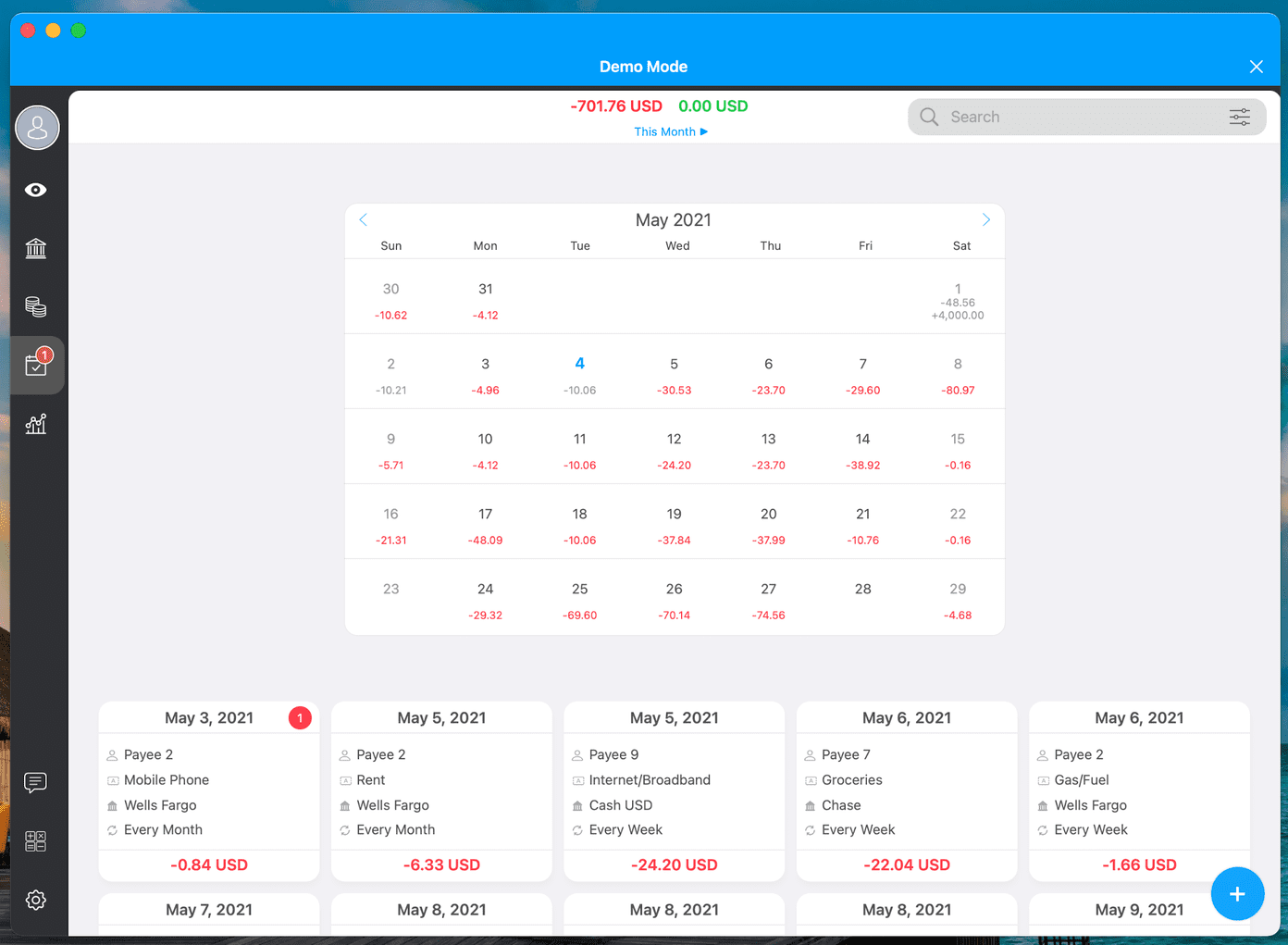

MoneyWiz comfortably tops our recommendation list with a beautiful UI, powerful features, and support for the most popular banks. By default, the app takes you to the home screen with all your expenses on the right side and wallets on the left sidebar.

You can create unlimited cash wallets, attach investment account from sources like Robinhood, Binance, and even integrate bank connections from popular institutions such as CapitalOne, Chase, and Wells Fargo. The app supports over 40,000 banks in 55 countries via 4 data providers.

Click on the + icon, and you can easily create a transfer, expense, or income entry in the app. We like how all the buttons are big and recognizable to take advantage of a big screen.

We are a fan of the calendar view. It lets you quickly glance at the expenses by date. Additions like the calendar view encourage you to use finance apps on Mac over mobile.

Other features include automatic detection of transfers and refunds, several options, bulk edit, group accounts, multi-currency support, and more.

The app is free to download. Premium subscription (£4.99/month or £48.99/year) enables syncing wiht your bank account and multi-device sync with a MoneyWiz Cloud account.

2. Money Pro

Money Pro continues to be one of the popular paid finance apps for Mac. The app comes bearing a default theme with a dark blue shade. It sure looks good on the Mac compared to a boring white theme from rivals.

Money Pro focuses on bill planning, budgeting, and keeping track of your accounts. The developers claim that the app is suitable for home and businesses. The Calendar view is fantastic. You can mark days on the big calendar when your bills are due. You can can also schedule recurring bills with specific dates.

Other notable features include the Today view, reminder for bills due, the ability to create a budget, budget rollover, and bank connection. You can split transactions and use custom icons to represent the income or expense.

Money Pro offers two types of subscriptions include Plus and Gold. They start at $2.99 and $6.99, respectively. The biggest difference between the two plans is the bank connection feature. If you need that, then go with the Gold plan. Otherwise, you will be perfectly fine with the Plus plan.

3. Money

The above two finance apps for Mac are suitable for power users that want every possible option to manage expenses. Money takes a rather simple approach to manage budgets and expenses.

Open the app, create an offline account, and you are all set to add income and expenses entries. As for add-ons, one can create a custom budget based on preference, schedule expenses, create in-depth reports, and view all the transactions in one place.

We like how Money takes advantage of desktop and offers more data to glace over a single screen. The keyboard shortcuts help you to quickly navigate through the app.

Money app is free to download. You can purchase the premium version at $50 per year to unlock the bank connection feature that is available for more than 50 countries.

4. Toshl

So far, we have talked about dedicated Mac apps from the Mac App Store. Let’s explore a couple of web-based solutions.

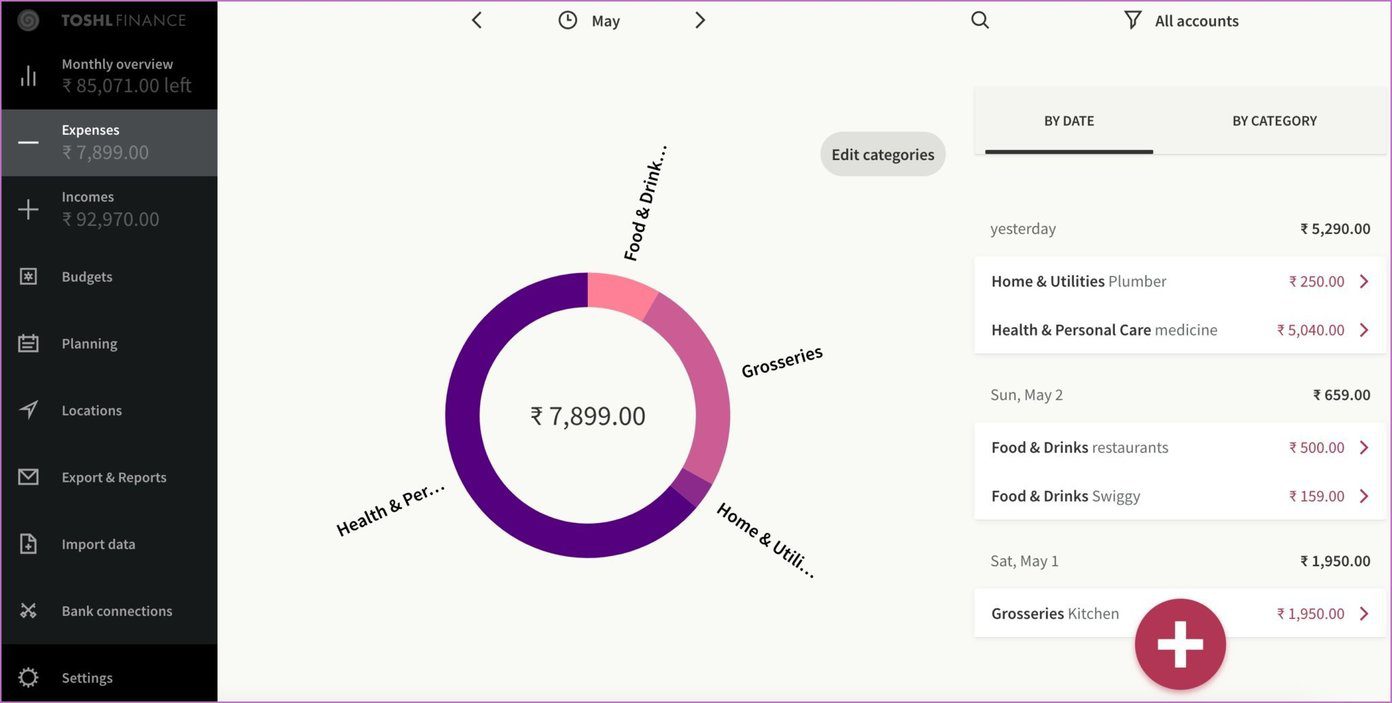

One such option is Toshl that has made a name for itself with a unique UI and rich features. Of course, you need to sign up for the service. We like how Toshl has utilized the big screen and offers all the relevant data such as monthly overview, expenses, income, budget, export, transactions, with eye-catching charts and data in a single place.

Toshl also offers a bank connection function. Add your bank details, and the app will fetch all the information from debit and credit cards. Export is where Toshl simply shines over rivals. One can export an expense file in CSV, Excel, PDF, or OFX format.

Toshl is free to download and use. It’s available on all platforms, including Android, iPhone, and Web. Toshl premium is priced at $50 per year with the bank connection feature.

5. Spendee

Spendee recently received a huge makeover with v5.0 on the mobile and web. And oh boy, the company has hit it out of the park with new UI and features. Spendee home allows you to glance at wallets, transactions, charts, and more.

You can create unlimited wallets, add bank connections, define budgets for a category, and even customize tags, categories, and more.

The export options are limited. Also, you will have to spend some time learning about all the possible options offered on the web. Spendee is available on iOS, Android, and Web. The premium version costs $39.99 per year that unlocks wallet sharing, bank connection, and more.

Manage Finance Like a Pro

Go through the apps list above and keep track of every penny on the Mac. The bank connection feature is handy as well. Remember to check if your local bank is supported before committing to a paid plan. Which app did you end up with on the Mac? Share your pick in the comments section below.

Next up: The iPhone ecosystem is also filled with finance apps. Read the post below to learn about the top five expense tracking apps for iPhone and iPad.

Was this helpful?

Last updated on 13 July, 2021

The article above may contain affiliate links which help support Guiding Tech. The content remains unbiased and authentic and will never affect our editorial integrity.